Grant’s Kōrero: Property Values

Being the end of our financial year, we are now going through the process of formally updating the valuations of Whai Rawa’s investment properties at 30 June 2023. These valuations are performed by independent registered valuers and recorded in our financial statements. If the valuations have increased, this will be recorded as a gain. If the valuations have gone down, it will be a loss. In the past, we’ve experienced some large valuation gains.

Rising interest rates are having a big impact on property valuations. Higher interest rates mean that it’s more expensive for a developer to borrow (to buy land and build houses) and more expensive for an investor to buy a commercial building using bank finance. The developer and investor will look to pay less for the land or building – so interest rates are putting downward pressure on property prices, and therefore on property valuations.

What we’ve seen recently is that property companies and funds listed on the New Zealand Stock Exchange have recorded valuation losses of between 4.2% and 7.1%. So, while Whai Rawa holds good investment properties, we don’t expect a valuation gain this year.

Valuation gains and losses need to be put in context. Firstly, they are gains or losses on paper. They’re not an actual gain or loss made on selling a property.

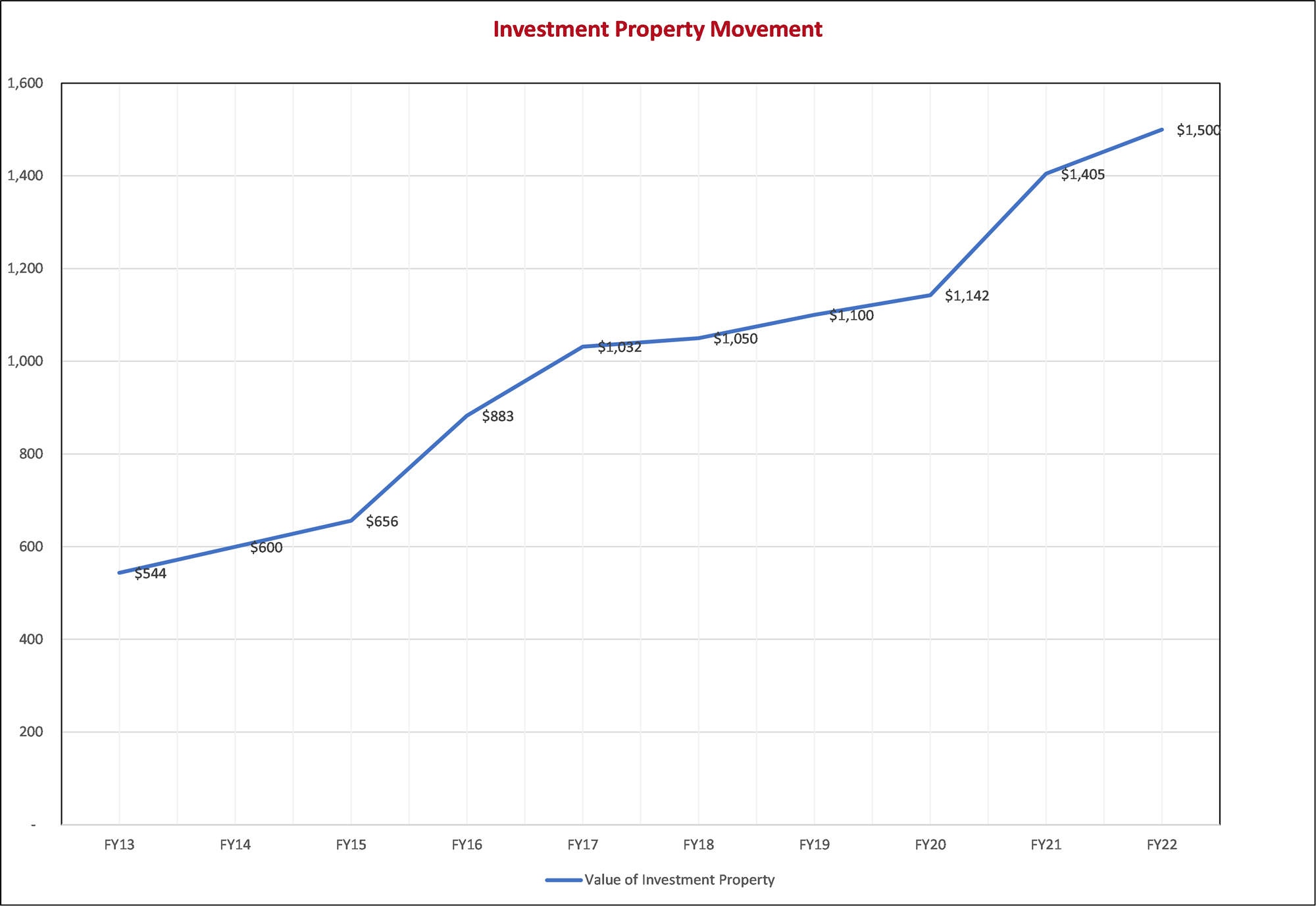

And if Whai Rawa were to have a valuation loss this year, we would expect that it would only represent a small proportion of the very large gains we’ve made on investment properties since we’ve held them, so any change this year needs to be seen in that light. This is shown clearly in the following graph showing the starting value of the property portfolio at the beginning of our 2013 financial year, adjusted over time for subsequent valuation gains:

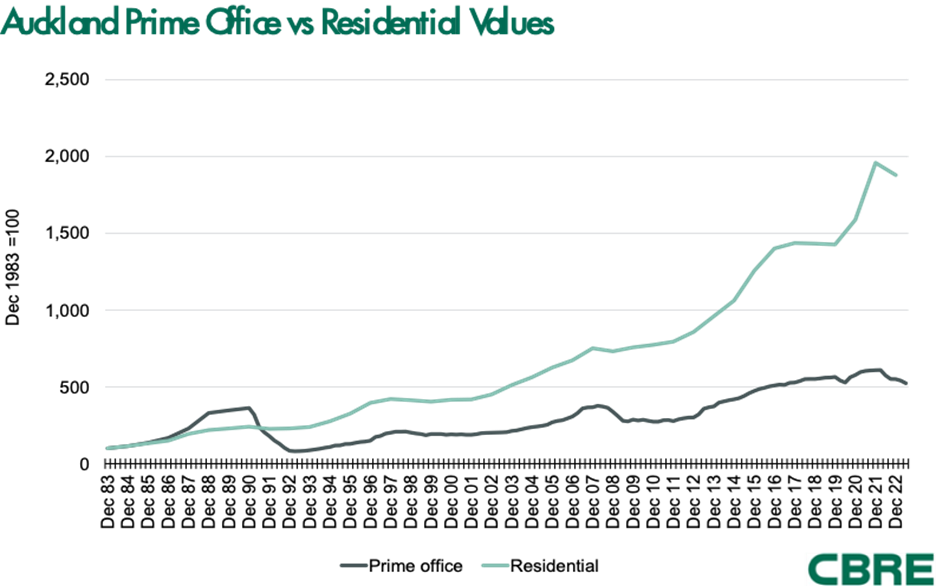

Finally, we need to expect in some periods property markets and valuations will not always rise. CBRE kindly provided us with the following graph which shows Auckland office and residential values since 1983. Those values at various points have declined or flattened, but over time have risen. As a long-term investor, Whai Rawa can focus on the longer-term.

Of course, as the valuations of properties are pushed down, then there is an opportunity for Whai Rawa to buy assets at a good price. Our most recent joint venture with Precinct Properties, where we bought a share in two commercial office buildings in Te Tōangaroa, is an example of us taking that opportunity.

Looking ahead, we’re really excited about the joint venture with Precinct Properties and the work we will do to upgrade the two buildings and improve their levels of tenancy. We’ve also recently refurbished Mahuhu Eatery in Aecom House, and there is our ongoing programme of activation through whānau art in Te Tōangaroa that will continue. The most recent stage of our residential development at Oneoneroa has sold well and we only have one unit left out of 24 to sell, which is a strong result, and we are still aiming to come up with targeted development in places where we are confident we can bring something appealing to buyers to the market.